We are often distracted by tying lead/sales value back to specific marketing activities, but what about measuring long-term brand health?

One unchanging principle of marketing is that brand growth is driven primarily by acquiring new and light buyers.

Furthermore, brand awareness has been shown to be a leading indicator of market share, and a key measure of how successful your brand has been in reaching potential new buyers.

Of course, brand awareness should be considered alongside measures such as brand salience (the propensity of your brand coming to mind in buying situations), and perception (customer perception of your brand), but a focus on growing and measuring brand awareness should be a fundamental component of your marketing strategy.

How to measure brand awareness

There are plenty of ways to measure brand awareness, varying in complexity, cost, reliability and accuracy. Different models will be better for brands at different levels of digital maturity, but it’s important to use at least one of these measures as a starting point.

Brand tracking software

There are a lot of tools out there that are able to measure brand awareness using representative samples in a variety of business categories.

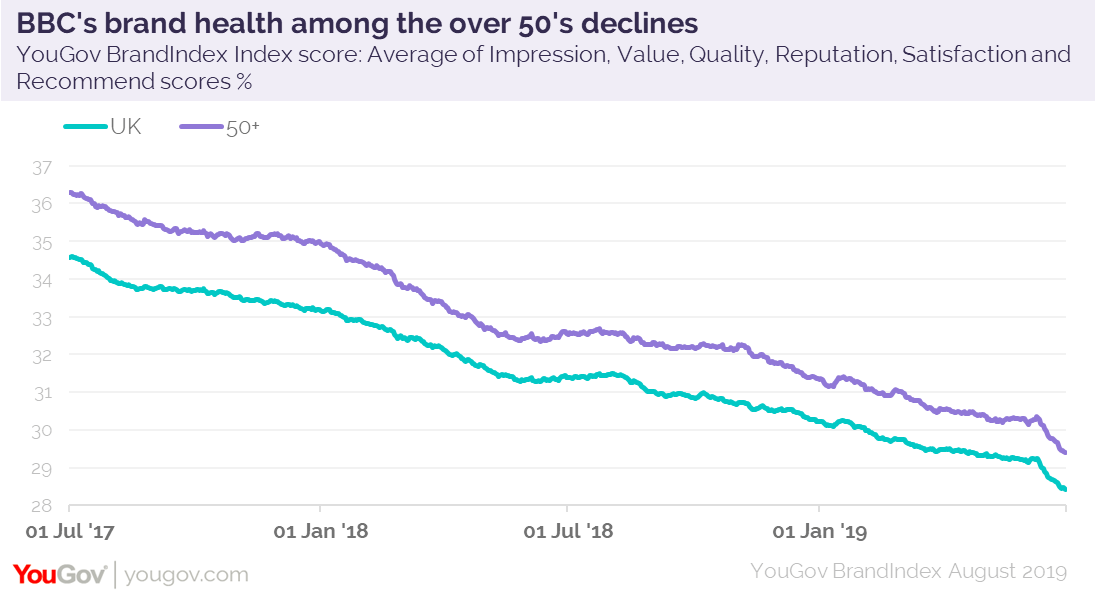

Companies such as YouGov and Kantar have active consumer panels, and are designed to offer large brands daily updates on brand awareness, and other ‘brand health’ metrics such as perception, satisfaction, and feedback on specific marketing campaigns.

Using premium brand tracking software will allow you to benchmark against historical data to identify long-term trends, track daily changes in brand perception and react quickly to short-term brand health changes.

Cost: £££££

Accuracy: High

Brand surveys

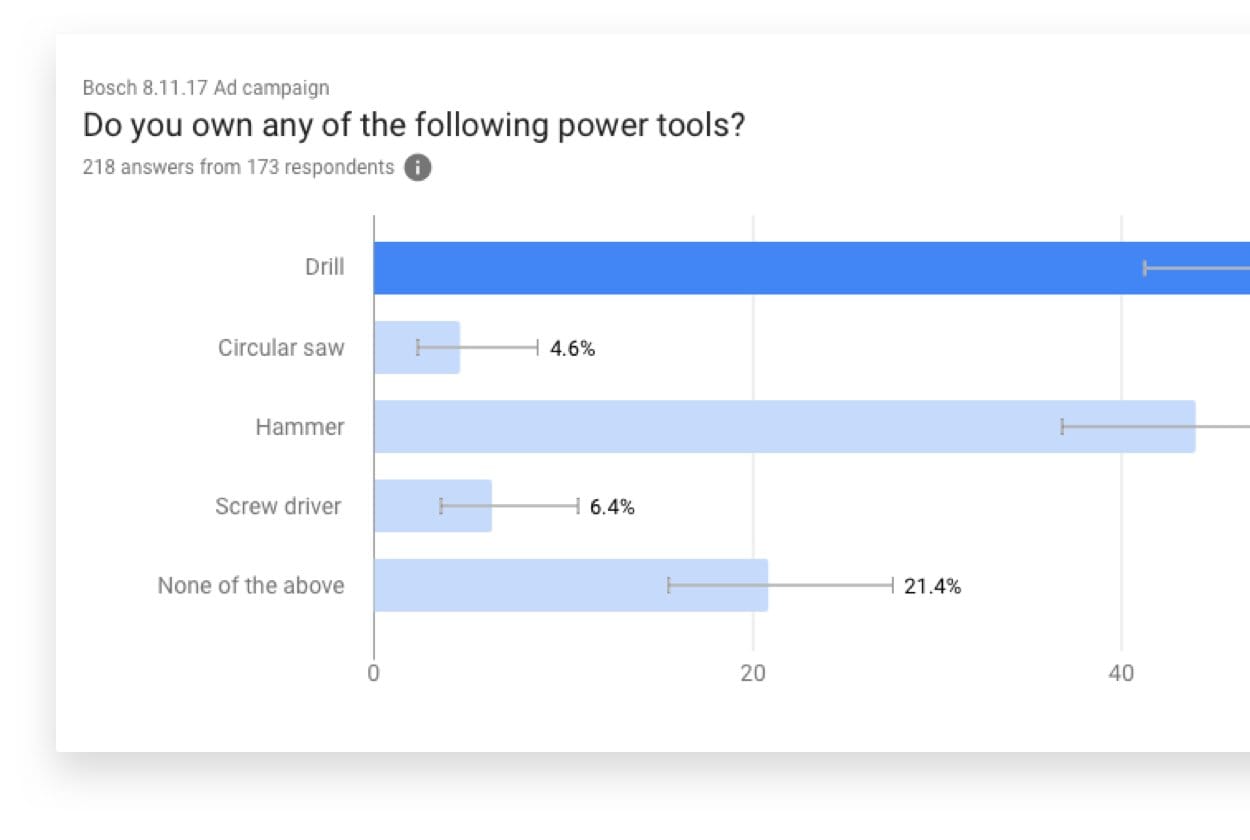

Using surveys to measure brand awareness means approaching the total market, rather than surveying your own existing customers.

Focusing purely on awareness, there are two measures to consider:

- Unaided brand awareness (e.g. “name 5 supermarkets in the UK that come to mind.”)

- Aided brand awareness (e.g. “which of these X supermarkets are you aware of?”)

There are a number of ways you can conduct brand surveys. Google surveys is a cost-effective option with huge reach, while there are a variety of research companies who are able to run surveys and access specific market segments at a slightly increased cost.

Cost: ££

Accuracy: Medium

Share of voice

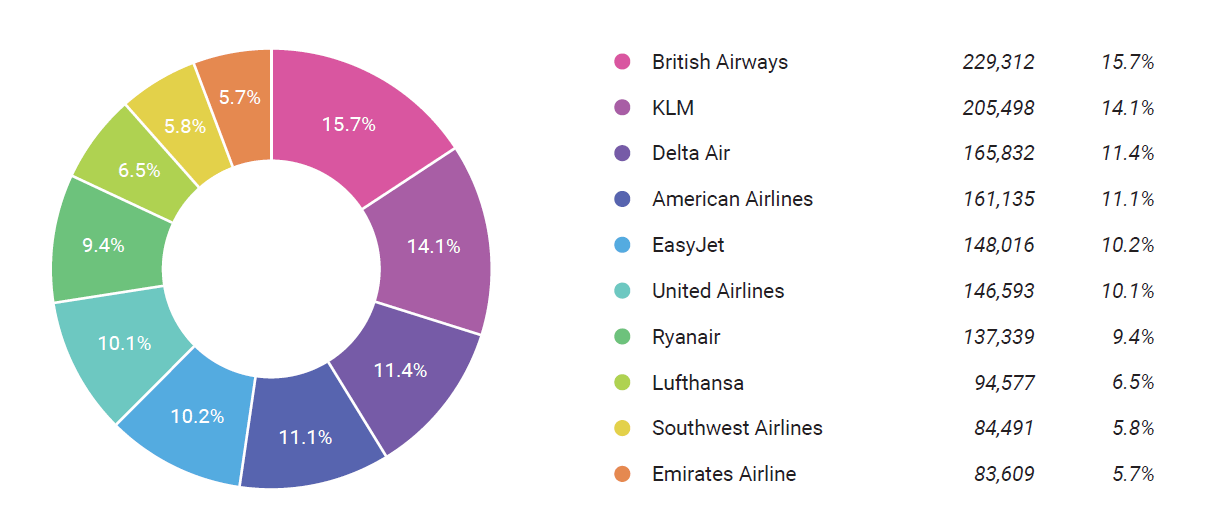

Share of voice (SOV) is a measure of the total marketing real estate your brand owns compared to your competitors.

Your brand metric / Total market metric x 100 = Share of Voice

These metrics would typically include social mentions, paid media impression share, paid media traffic, organic traffic, social media followers, and overall website traffic – essentially any metrics you can lay your hands on. SOV can be calculated on a per channel basis, or combine all channels into a single measure.

In practice, this is a very complex metric to gather, and in my opinion lacks accuracy due to the huge volume of platforms it would need to be pulled from to be a true measure.

Cost: £££

Accuracy: Medium

Share of search

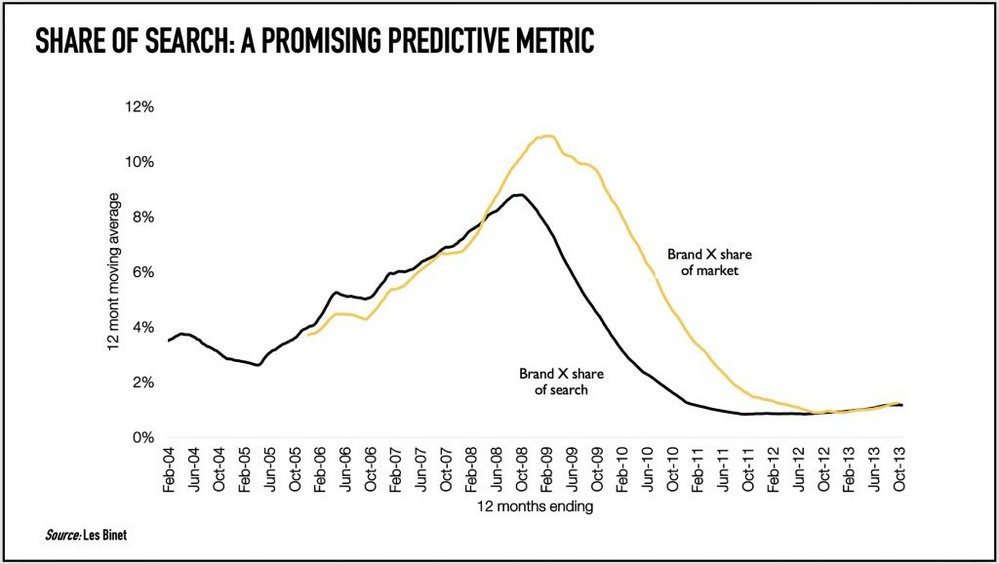

Share of Search is a 12 month moving average of the searches on a brand’s name compared to the same 12 month moving average of all the brands in the same sector.

This data can be pulled from Google Trends, using the volume of searches for your brand name, against the volume of searches for a set of competitors you wish to track performance against. Like Share of Voice, it’s a good measure of relative brand growth.

This can be a simple but useful tool, but the data is somewhat limited. For example, if your brand name is a generic term such as ‘Shell’ or ‘Seat’, then this will conflict with searches for completely different entities.

Whilst universally accessible, for many brands, the problem in using Google Trends is that they simply do not gain enough data to draw any conclusions.

Cost: £

Accuracy: Medium

Website performance

There are a number of semi-reliable methods of tracking brand performance via tools such as Google Analytics and Google Search Console.

However, it is worth noting that since Google moved to secure search in October 2011, measuring keyword traffic has become more difficult with the vast majority of keyword data hidden behind ‘(not provided)’ in the name of privacy.

That being said, there are a few metrics we can use via these tools to gauge brand awareness.

Direct traffic

A very common misconception around this metric is that direct traffic is registered when a user visits your website by typing your URL into their browser, or from bookmarking your site.

However, Google also class users from any source where Google Analytics can’t detect referral information as ‘direct’. Given the rise in people opting out of cookie tracking, this means that more and more traffic is being classed as ‘direct’.

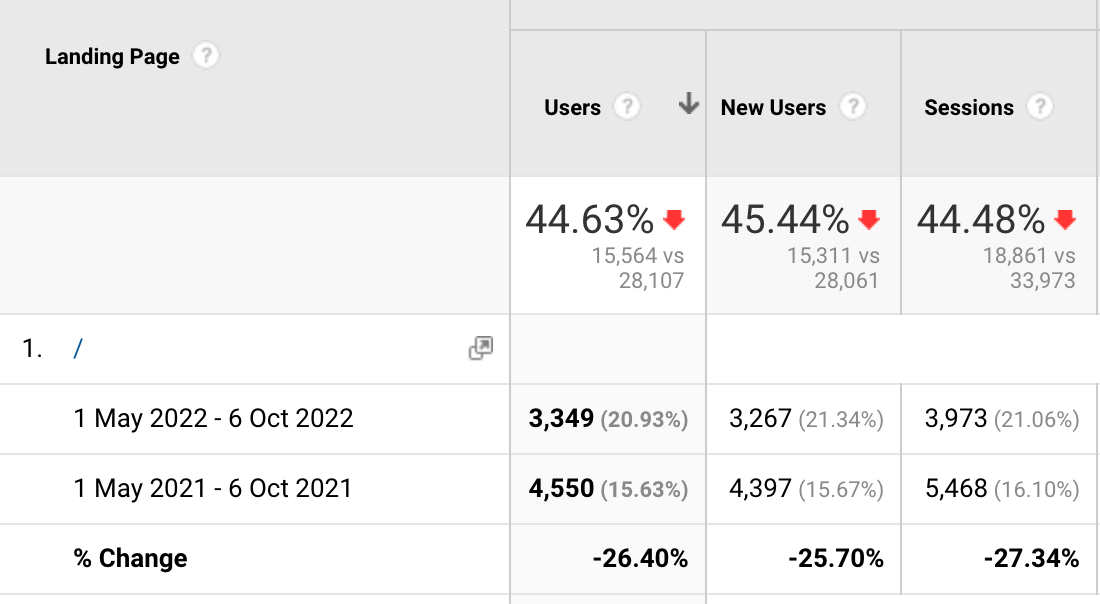

There are ways around this, and reviewing the landing pages of your direct traffic referrals is a good way to get a handle on brand awareness trends.

For example, direct traffic to the homepage will be fairly accurate, as it’s typically not a destination used in ad campaigns or that will be triggered ‘non-branded’ organic queries.

There are a lot of caveats I’d add to using direct traffic as a brand awareness metric, as there are so many factors that will influence it. For example, increased advertising activity (search ads for your brand name), or competitors bidding on your brand.

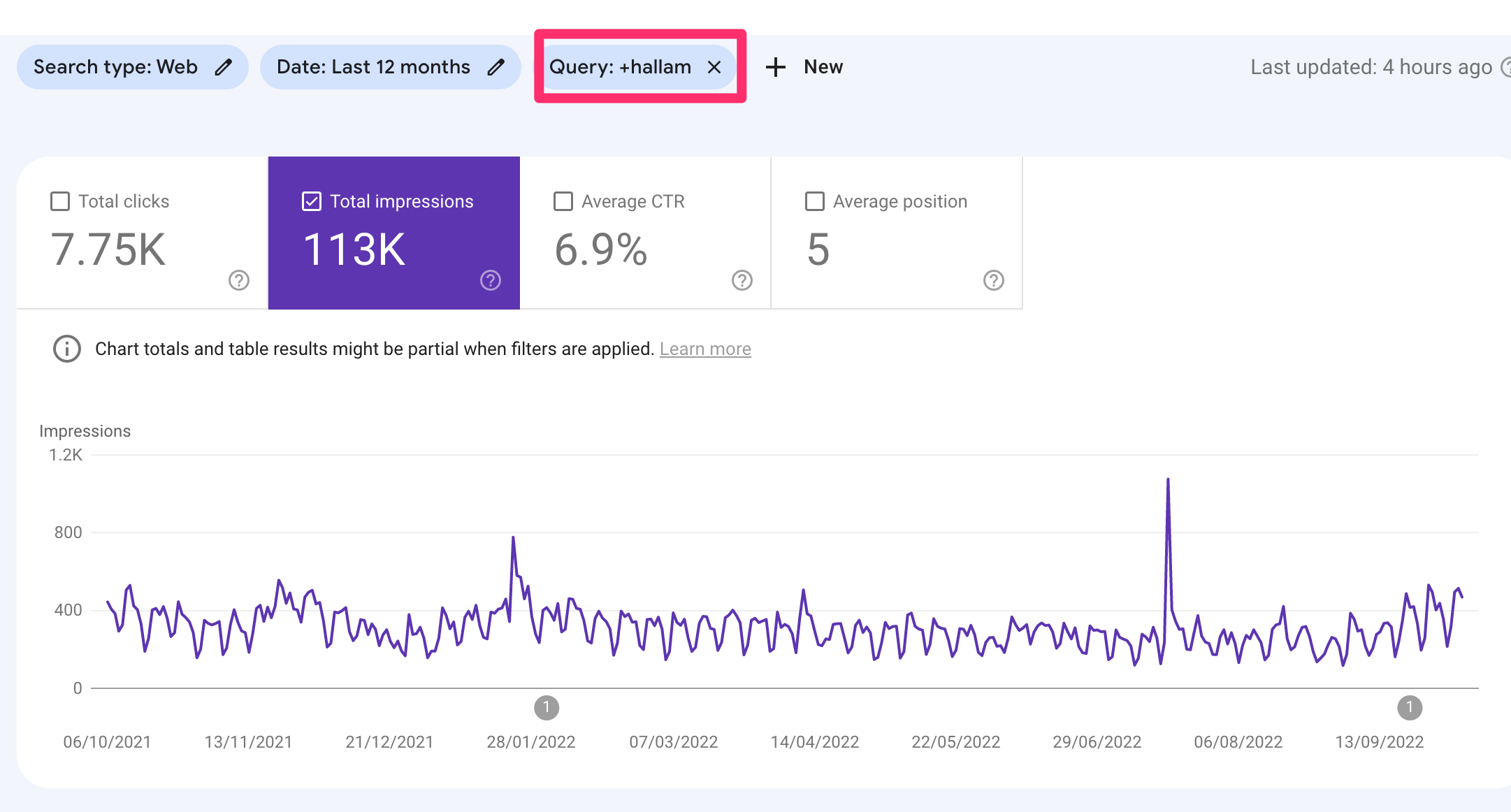

Brand interest (Google Search Console)

Google search console reports on the number of impressions and clicks your website receives for queries related to your brand name.

Using a filter to assess brand interest over time for searches related to your brand is a better measure in my opinion than the direct traffic method explained above, but still has limitations.

Not every brand will rely on a website to sell their products. FMCG brands rely on retailers to sell their products, and using website data will be meaningless as a brand awareness metric in this industry.

Cost: £

Accuracy: Medium

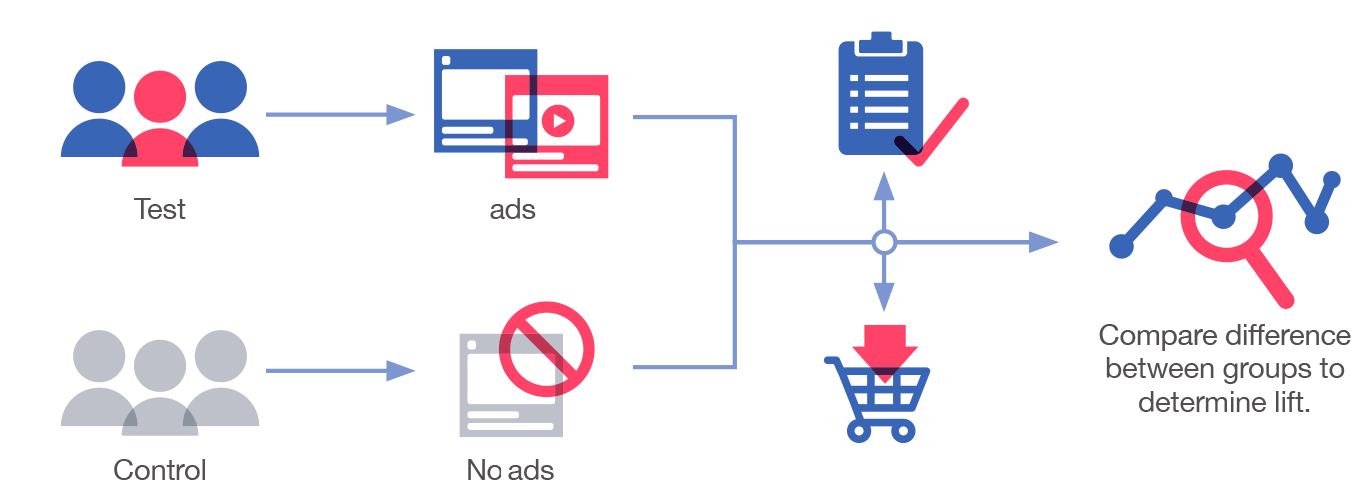

Brand lift studies

Many advertising platforms offer brand lift studies, which will report back on the impact (‘lift’) of any brand awareness campaigns. These are useful measures that are provided to advertisers who spend substantial amounts on campaigns as a way of measuring brand performance.

Most large advertising networks offer brand-lift studies, which we have previously detailed. Common examples include:

- Facebook Brand Health Check – the Facebook Brand Health Check is free to use if you’re running any paid Facebook campaigns.

- YouTube Brand Lift – Google offers a brand lift and brand interest study at no cost. One incredibly helpful metric available through the brand lift study is the cost per lifted user.

- Programmatic Brand Lift – StackAdapt and other programmatic platforms will offer studies similar to those listed above, and will run the studies across the inventory (websites) they have signed up to their ad network.

Cost: £ (covered via ad spend)

Accuracy: High

Final thoughts

Growing brand awareness is a vital part of long-term business growth, and it should be measured regularly to ensure you’re able to make smarter marketing investment decisions.

Brand tracking is a cycle that never ends, so ensure that you’re reporting on this regularly alongside any bottom-funnel metrics (e.g. ROAS, CPC) to give a balanced view of the success of both long, and short-term marketing activities.

As mentioned at the outset, brand awareness is a key indicator that customers have heard of your brand, but don’t stop there. Use advanced brand tracking to measure the perception of your brand vs. competitors to gain deeper insight into what customers think of your brand, and to benchmark against competing brands.