You’ll have no doubt heard about the cookieless future over the past few months, the impending era in which third party cookies, the critical component of digital advertising and analytics, will be sunsetted across many of the world’s leading web browsers including Safari, Chrome and Firefox.

Third-party cookies have allowed advertisers to follow internet users across the web and target them with ads, giving unique insight into how audiences behave in a way other forms of media simply cannot do. But this has, many feel, been at the expense of people’s privacy online.

Google’s deadline to remove third-party cookies from Chrome by the end of this year is fast approaching and the media industry is on the verge of the single biggest change to digital advertising since its inception.

Forget about workarounds

As we’ve been able to deliver relevant ads to consumers across the web using third-party cookies as the basis of targeting, there has been a huge erosion of trust from consumers.

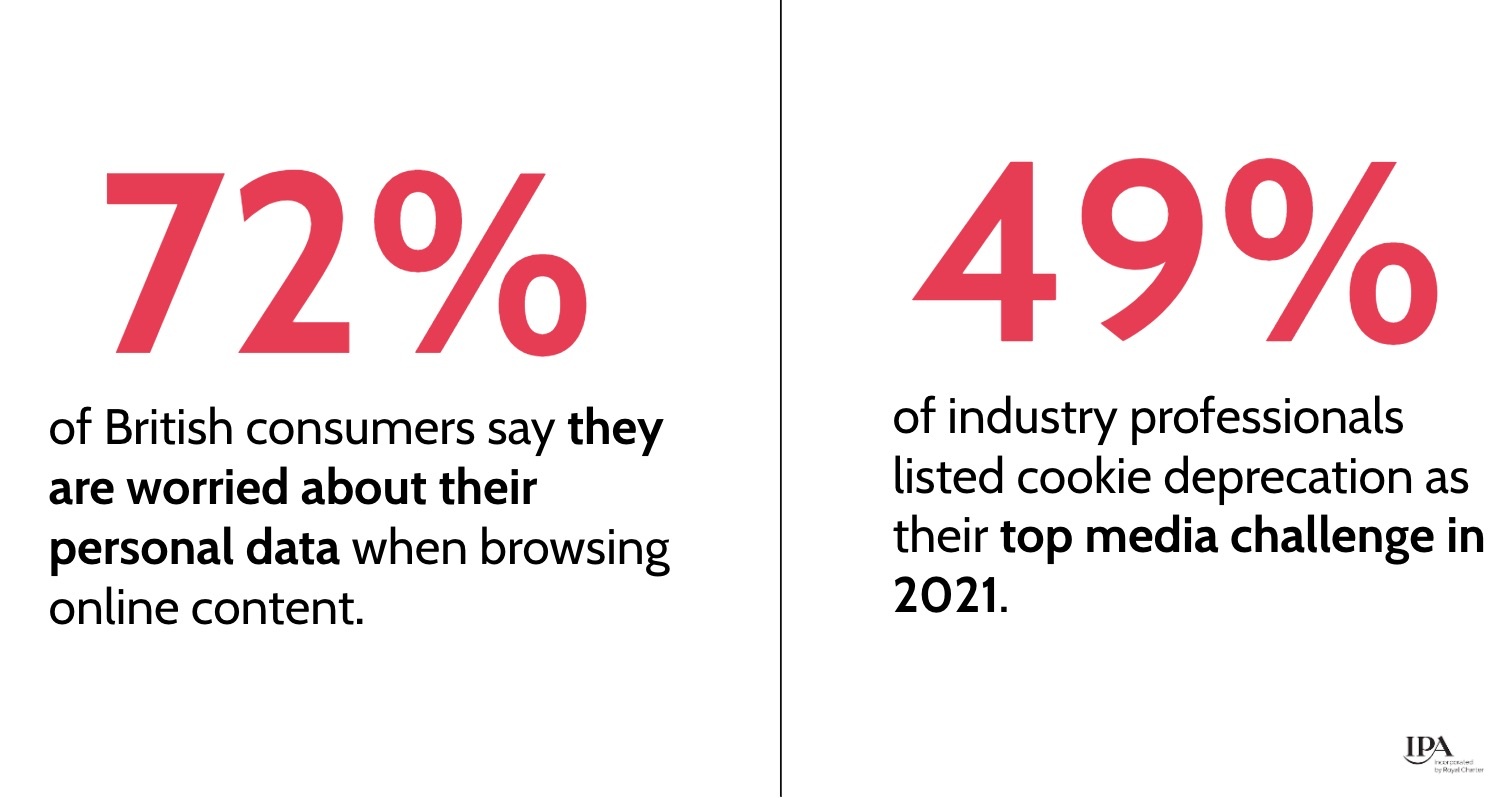

In fact, a recent YouGov survey found 72% of British consumers are worried about their personal data, while at the same time 49% of industry professionals listed cookie deprecation as their top media challenge in 2021.

There is no avoiding the fact that if we don’t evolve our approach to privacy and the implications on advertising we risk the death of the open web as we know it.

The attribution challenge

The decline in third-party cookies leaves advertisers trying to figure out how to plug the cookie-shaped hole left in their attribution strategies.

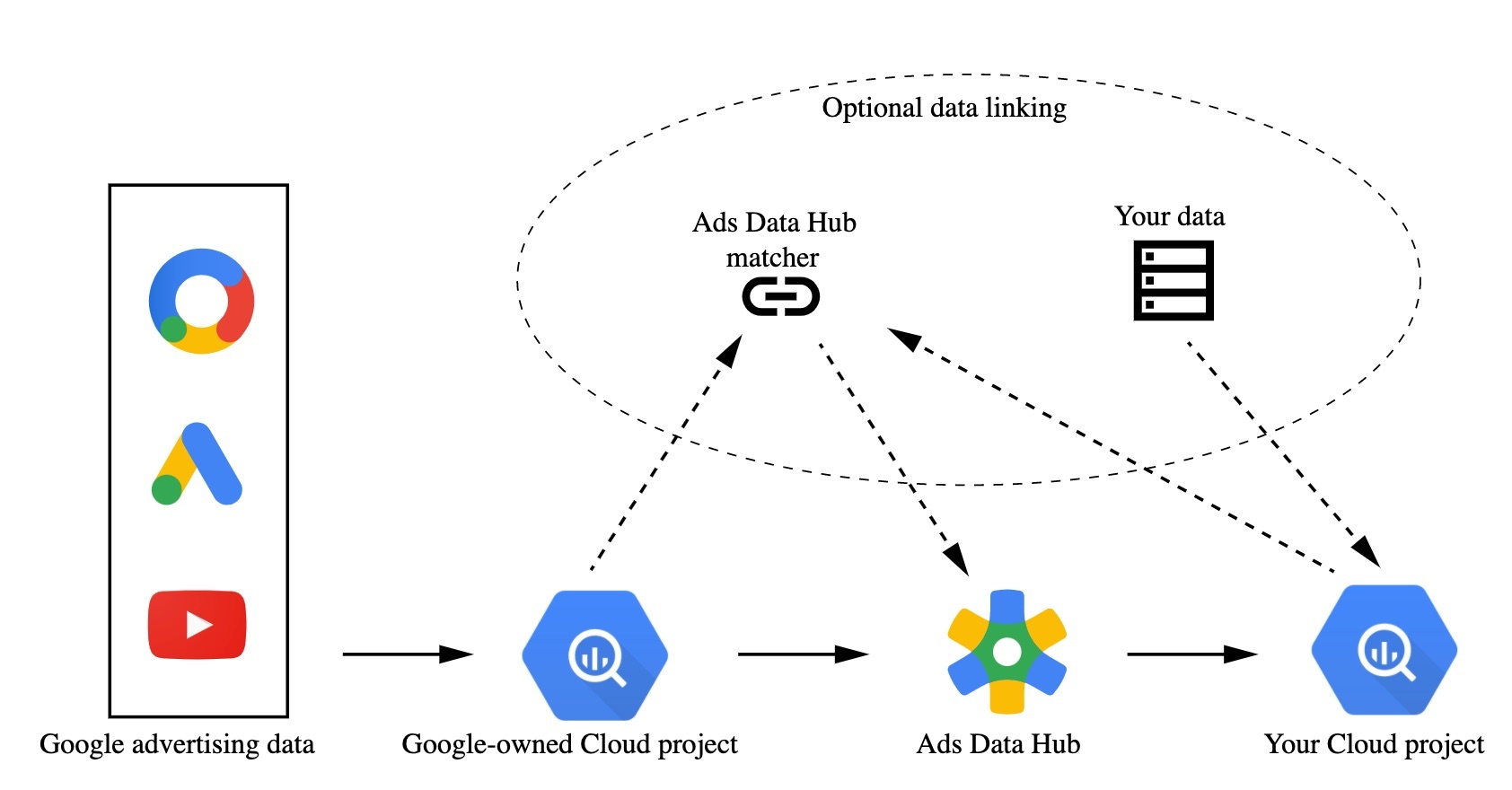

With the loss of third-party cookies and transferable user IDs, data is now trapped within “walled gardens” such as Google and Facebook. You can still make use of this data – just not in exactly the same way, and only on the platforms terms. This is where the concept of data “clean rooms” comes in.

For example, Google will allow advertisers to assess data within the Google ecosystem. Google’s Ads Data Hub allows you to analyse ad performance and upload first-party data to segment audiences, analyse reach and frequency, and analyse different attribution models.

This is certainly useful within a single platform, but still leaves a major challenge of more holistic attribution modelling across different networks. We are already seeing the first examples of this now across Google and Facebook since the recent Apple iOS 14.5 update.

The biggest impact will be on those types of advertising likely to come earlier in the process than the last click before conversion/sale than others, and without cookies, advertisers are at risk of being misled into thinking that the end-of-journey (last-click activities) are more effective than they really are.

What this means for ad targeting

For many years now, advertisers have been able to target ads against audiences based on data aggregated from third-party cookies. This hyper-specific targeting has been one of the main drivers of advertising spend away from traditional media and into digital media.

The types of advertising most impacted by the phasing out of third-party cookies will be those relying on publisher-shared data to power advertising targeting which includes tactics such as:

- Programmatic display

- Multi-channel remarketing

- Native advertising

Building a robust strategy for the collection and curation of first-party data will be essential to counteract the loss in third-party data for ad targeting. Specific tactics to create authenticated first-party audiences will vary widely, but the common theme will be value exchange.

Your first-party data can be used to sync with platforms such as Facebook and Google, who will match your data against anonymised users for more accurate targeting that is likely to help advertisers retain the relevance they’ve become accustomed to over the past few years. In short, the more first-party data you can bring to the table, the better the chance of any third-party data matching the characteristics of your existing customers.

From context to cookies, and back again

Before third-party cookies, brands bought ad space using contextual targeting. For example, Nike may have simply chosen to display ads on websites whose readers were likely to buy sportswear, such as Sky Sports or Men’s Fitness. However, in the late 2000’s most advertisers pivoted to one-to-one, hyper-personalised advertising which relied upon third-party cookies.

The loss of third-party cookies will see the addressable audience pool reduce dramatically, and in order to reach new audiences at a greater scale, businesses must turn back to contextual advertising as a privacy friendly targeting tactic.

Keyword targeting via paid search is an example of contextual targeting, as is placement targeting via display networks. And when run correctly, you’ll be reaching the right people, at the right time, in the right place with your advertising.

However, with more advertisers turning to contextual over the coming months, strong creative will become even more crucial for your business to cut through the noise as advertisers move from a 1:1 to a 1-to-many targeting approach.

A new dawn for digital advertising

Third-party cookies and the many tactics they’ve supported will be gone some time in 2022. The question is how you will evolve in response.

The biggest challenge facing advertisers is around resetting expectations around reporting and attribution. We have become accustomed to granular, user level reporting thanks to third-party cookies which will become impractical in the future.

We will need to become comfortable with imperfect reporting and able to dissect the conflicting models that may be presented by different advertising platforms.

This could actually incentivise brands to dedicate the majority of their ad investments within one platform to reduce the fragmentation of data and insights. Platforms like Google are in a great position to offer this as they have coverage across the worlds largest display, video and search platforms.

The irony here could be that increased user privacy leads to big tech platforms capturing an even greater share of advertising revenues.