As any good marketer knows, a strong marketing plan relies on the following tried and tested elements:

- Market research

- Segmentation/targeting/positioning

- Objectives

- The 4Ps & tactical planning

For a refresher, take a look at Mark Ritson’s post on the key steps for marketing planning.

SEO analysis can provide crucial value in the earliest stages of market research and strategy planning for brands. Research into customers and competitors is an SEO’s bread and butter, through daily use and familiarity with tools such as Google Search Console, Google Trends and SEO tools such as SEMrush and Similarweb. SEO isn’t something we should only start considering later down the line, once all of the research and planning is done, in order to drive organic traffic and leads/sales via a website.

When you’re looking for a solution to your problem, whether that’s a new hairdryer because yours just blew up or a new piece of software to manage HR processes in your business, where do you turn? Search engines of course! It’s estimated that Google processes approximately 63,000 search queries every second, translating to 5.6 billion searches per day and approximately 2 trillion global searches per year.

This means that all those search terms, phrases, questions and problems posed by your customers every day to Google provide a treasure trove of useful information to help inform your initial market research, strategy and tactics. That’s if you know where to look and how to utilise the data effectively.

How can SEO support at the market research stage?

The all-important market orientation and research stages of developing a marketing strategy are what Mark Ritson calls “killing the hypothetical customer”, where marketers “embrace customer complexity which is revealed by research”.

By the nature of the work they do, SEOs tend to be led by in-depth research and testing of hypotheses rather than doggedly following best practices or thinking they know all of the answers. And this is exactly what’s needed at this stage of the process, so get them involved!

Here are some thoughts about what your SEO team can bring to the table in combination with the other qualitative and quantitative research you plan to carry out:

Market research

Understanding demand for your product & service(s)

Market research is carried out to test the validity of a business concept and refine a business plan. Key questions to understand include market size, market dynamics and customer need for products/services.

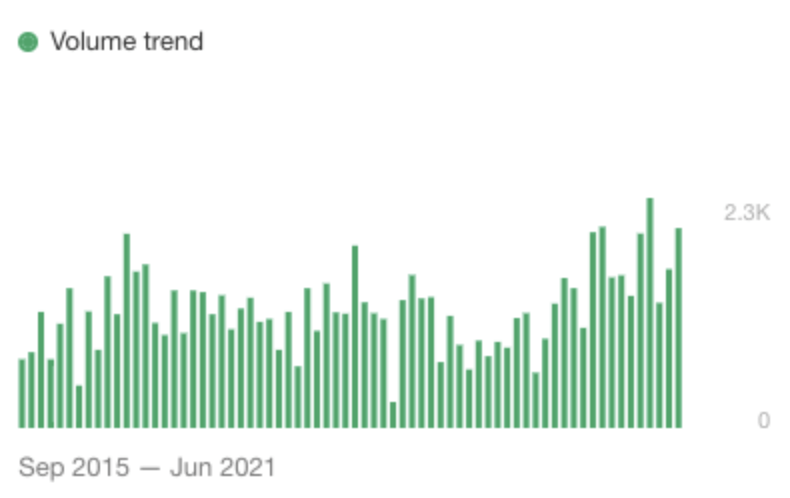

If you are starting a new business or planning to add a new product/service offering to your current business, keyword research by the SEO team can help you to understand whether there is search demand (people searching in Google for related keywords and phrases) for what you are planning to offer. They can also determine whether demand is growing or reducing over time using keyword research tools such as Ahrefs, Google’s Keyword Planner and Google Trends.

This may not be a deal-breaker – you might be an industry disruptor launching a super innovative product or service that people don’t know they need yet. But this information is still very useful to see.

In-depth competitor research to gain a full picture of the market

I can’t count the times clients have given us a list of their competitors, then when we cross-reference this with who they will be actually competing with in search they are either completely different or missing some key players. SEO can help to identify competitors that you’ve not even thought of or come across before. The competitors you are traditionally up against, for example in pitches if you’re a B2B company, or when your customers are browsing products in stores if you’re a B2C brand, are not necessarily your online competitors in search.

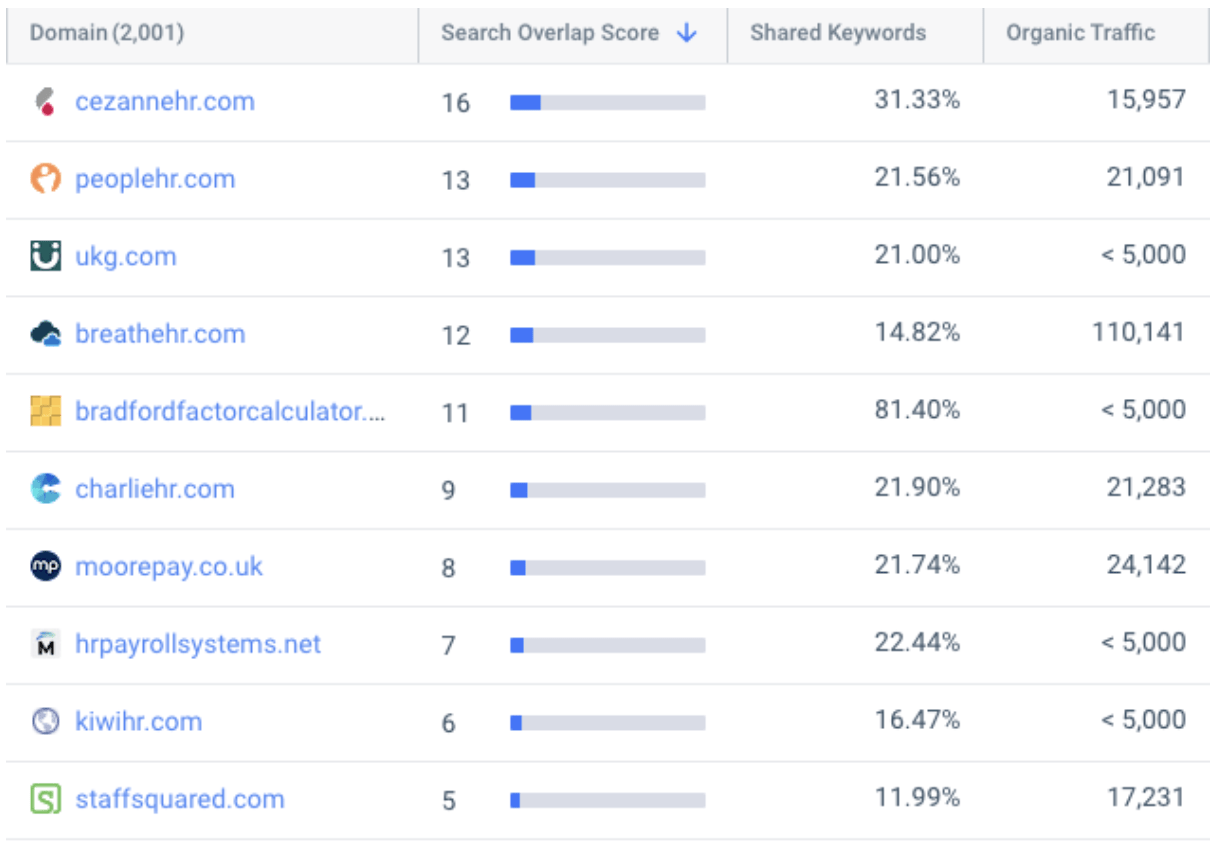

With organic competitor research, we can take your top ten (or more) core keywords relating to your product or service and find out who your top 10 competitors are in the UK organically.

If these are not identified at the early stages of the strategy planning, then this wealth of useful competitor data can arrive too late in the process. Competitor information is especially important when you are positioning your product and/or service in the market – if you don’t have a full picture of your competitors then you could be going in blind.

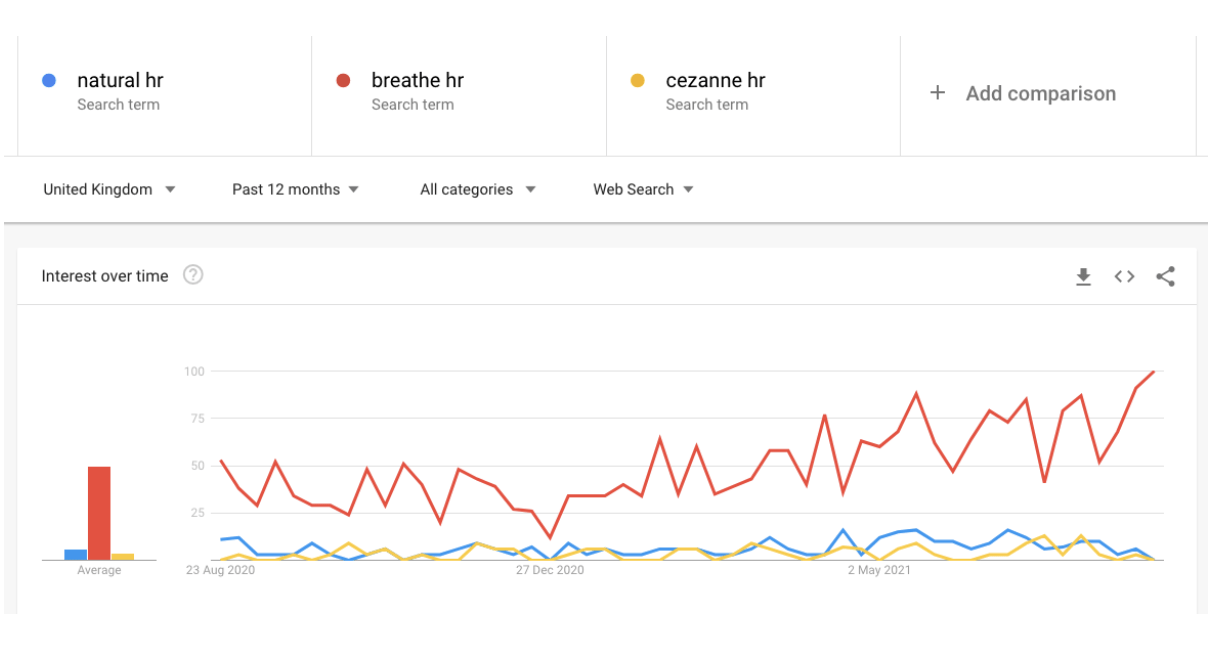

Here’s an example for the HR software market in the UK for a leading provider, Natural HR. Using an SEO research tool, we can understand who the top 10 competitors are in terms of organic search:

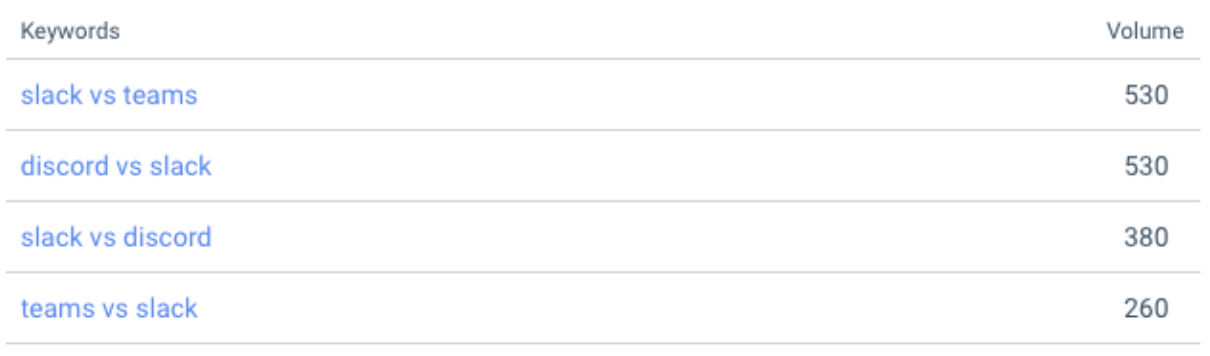

SEO teams can also provide you with data on which branded terms your customers are searching for, both for your own brand and competitor brands. This can highlight a host of comparison terms to help you understand how you stack up against your competitors in the minds of customers right now. We can then dig deeper into the keyword analytics. Take popular comms management tool, Slack, for example:

This data helps to highlight who your key competitors are in the minds of your customers, not just from an internal business perspective.

Initial competitor keyword research can also make it clear how competitors are currently positioning themselves in the market.

We can then answer the question, what are the top organic traffic-driving keywords to a competitor’s website? This will indicate how that competitor has optimised their site, which is in turn a decent reflection of how they have tried to position themselves to their target audience.

To go back to the HR software example, one of Natural HR’s biggest competitors is Cezanne HR. From looking at their top traffic-driving keywords, we can see they are positioning themselves not just as “HR software” but also “performance management system”, “HR onboarding software”, “recruitment system”, “absence management software” and more.

SEO research can also help you to understand your current market share as displayed by Google Trends branded searches as well as share of search calculations for a set of common keywords. This is useful for helping to build a picture of your current market share alongside other research being carried out.

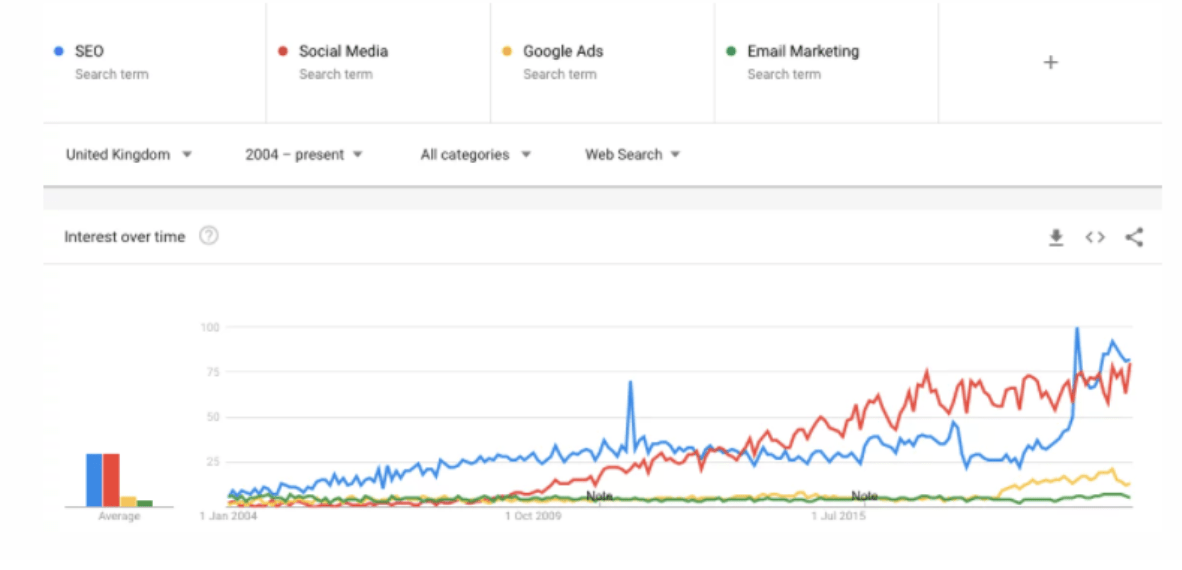

You can also use Google Trends for broader topic searches, to understand how the topics associated with your business, products and services have grown or declined in interest with searchers over time. Take the following example from the world of digital marketing – this data would be especially interesting to an agency potentially looking to expand their services or choose which ones to double down on:

Customer/Audience Research

Understanding current customer sentiment and attitudes to your brand

How do your customers currently see you in the market? Using Google Search Console data, we can understand the branded terms that your customers have typed into Google.

One client I have worked with recently is an eCommerce watch reseller who came to Hallam looking to build their brand and to be seen as more of a luxury retailer. A review of their branded terms driving visibility and traffic from the search results demonstrated that this could be quite tricky, and potentially not the best route, with the following terms driving impressions and clicks from the search results:

X = client brand

“X discount code”

“X voucher code”

“Is X legit?”

“Is X genuine?”

“X reviews”

“Are X watches real?”

“Is x fake?”

“Do X sell fake watches?”

“Is X real?”

Consumers were clearly unsure about the legitimacy of the brand as displayed by the wariness around purchasing, and also saw them as a budget retailer.

What do your current customers associate you with? What perceptions may we need to change? Organic search data can be used to answer these questions.

Understanding how customers refer to your products & services

You might think that your product is referred to as X, but actually, your customers are searching for Y – would it, therefore, be sensible to drop your internal naming conventions and use something that your customers are actually searching for when developing your products/service? This will help you avoid headaches down the line.

Too many times I’ve heard “we called our service X as that’s what customers call it”. But then lo and behold, the research shows that these terms are not searched in search engines by anyone…. Are you sure that’s what your customers use?

This will also help with positioning once you’ve decided which segments to target. What do you want your audience to know about in terms of product features, product benefits, but most importantly, the benefits to them as a customer?

Using search data to help to decide on geographical targeting

As part of the segmentation and targeting phase, you will be deciding which countries or regions you want to compete in. SEO can support you by carrying out initial keyword research in potential target markets to understand the size of current search demand for your product or service. This data can feed into the overall mix when it comes to geographical research into potential customers and determining the size of the market opportunity.

Customer pain points and needs help to refine your segmentation and decide on targeting

SEOs regularly research the queries and issues that customers are highlighting in search engines. This is especially important for the market orientation and research stage, but also the Product element of the 4 Ps.

“When we buy a product, we essentially “hire” it to help us do a job. If it does the job well, the next time we’re confronted with the same job, we tend to hire that product again. And if it does a bad job, we “fire” it and look for an alternative.”

“Jobs to be done” article on HBR

Research into the problems that consumers are having with a product or service provided by a competitor, or just generally the problems they are trying to solve without knowing what the solution is yet, should feed into your strategy.

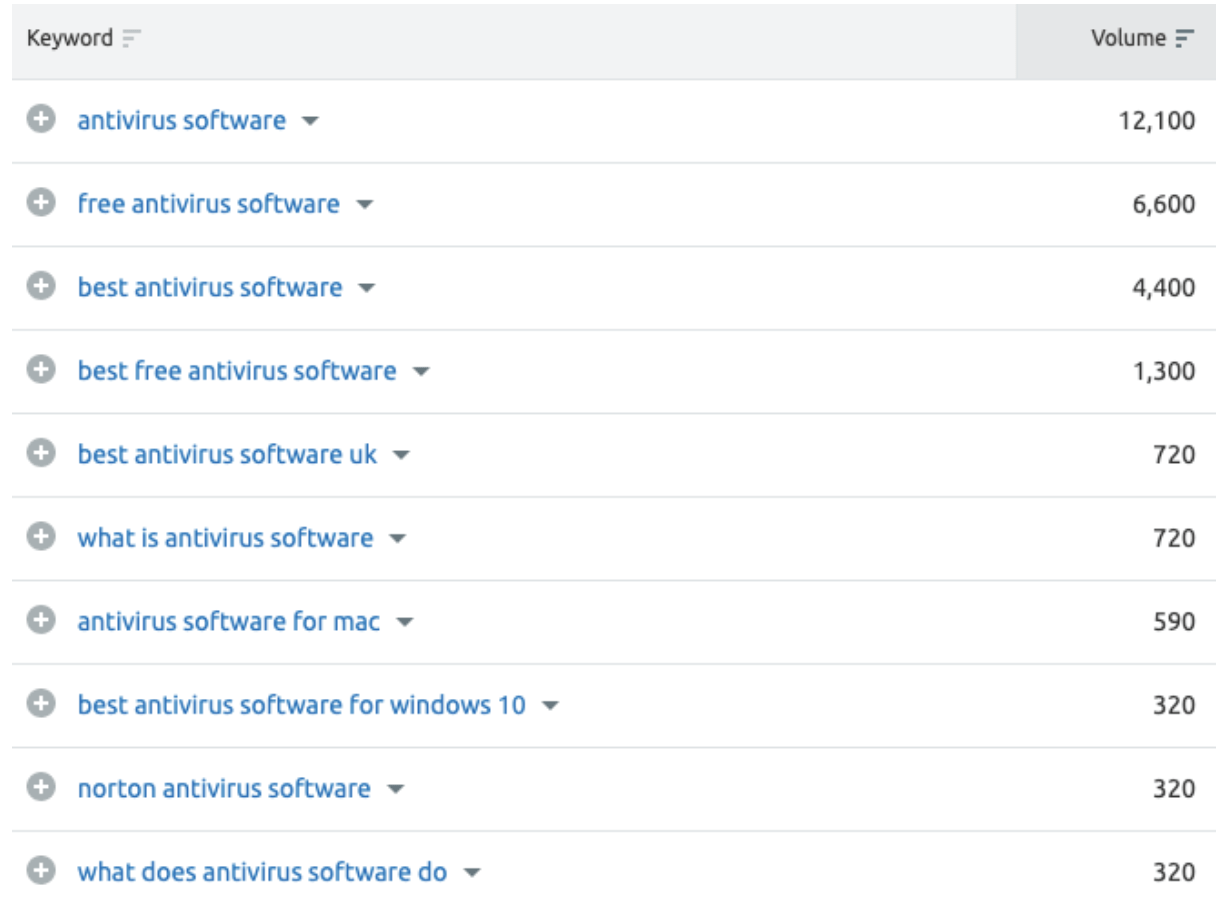

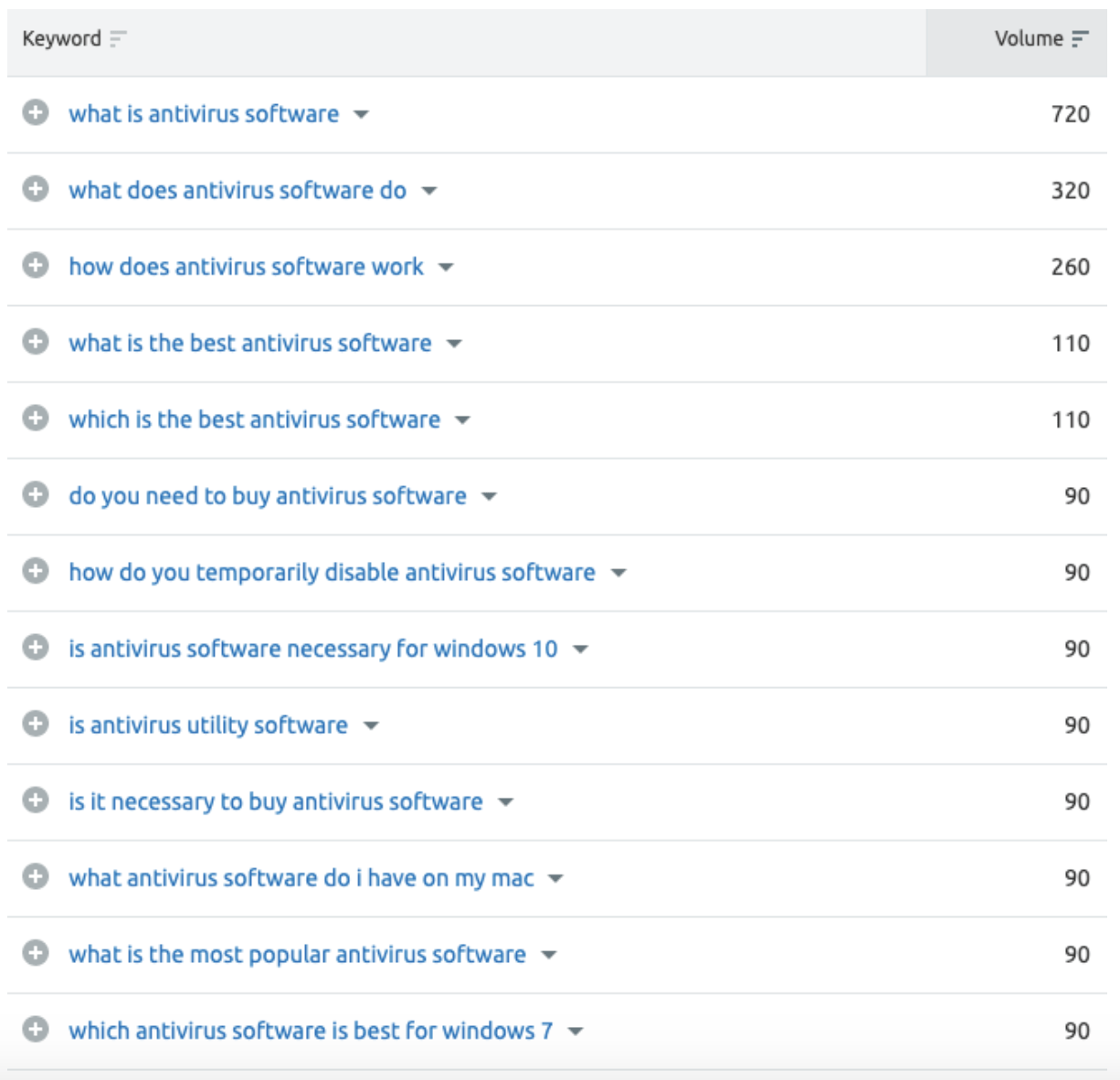

Take “antivirus software” as an example, below you can see a list of the most common search terms and questions:

What does this data allow us to infer about these potential customers?

- Norton Software is top of mind and a market leader in the mind of customer

- They need clarification on what it does and whether it’s necessary

- They want to understand and compare the “best”

- Mac users make up a higher proportion of searchers than Windows users

- Value is important – some users are looking for free software

This data by no means provides us with everything we need to know about our potential customers, and of course must always be taken with a pinch of salt rather than gospel. However, in combination with focus groups, ethnographic research, surveys and other secondary and primary research methods, it can help to provide a more rounded picture and possibly highlight some areas of focus.

It will be especially useful for more complex products/services such as SaaS providers, niche services or manufacturing.

Final thoughts

Too often, marketing decisions are made with no involvement from digital teams, and SEO in particular, who could have advised, for example, on how to position the brand in light of the wealth of insight and data they have into customers, their online behaviour, their interests and their pain points.

Don’t miss this opportunity.

If you’re a CMO, Head of Marketing, Product Marketing Manager or Brand Manager, speak to your SEO team or agency when planning your strategy for the coming year(s). Understand where they can contribute. Explain the process to them and ask for their input. Get them working on providing you with the vital insights and data you need that you can then combine with all the other research that you’ve done.

You won’t regret it.

If you have any questions, don’t hesitate to get in touch with us.