After facing unprecedented disruption during the covid years of 2020-2021, the travel industry is now on the road to recovery, with the numbers of flights and revenue of the hotel market exceeding pre-covid levels and continuing to grow.

At the same time, it’s unsurprising to note that the number of people using travel agencies has been declining for years, with more people doing their own research and booking online instead.

Even though there are now more opportunities to attract users at each stage of their travel-booking funnel through search engines and good SEO, the competitive nature of the industry still continues to make success difficult for travel agencies. With many SERPs dominated by Online Travel Agents (OTAs), such as Booking.com, Expedia and Tripadvisor, ranking organically is a challenging prospect. In fact, travel is one of the most challenging industries to rank well in organically.

We’ll take a look at why it’s such a hard industry to compete in organically, and outline a few strategies that are working well for some of the top players.

Why is travel SEO difficult?

An OTA provides users with the convenience of searching for and booking various travel products and services on their website or online platform like flights, hotels, car rentals, holiday packages, activities, tours, cruises and more. OTAs have become popular due to their convenience and ability to compare prices and services from multiple providers in one place.

These agencies establish direct partnerships with airlines and hotels, earning a commission for every booking processed through their platform, and are usually able to secure better prices from service providers or opt for lower profit margins on each booking.

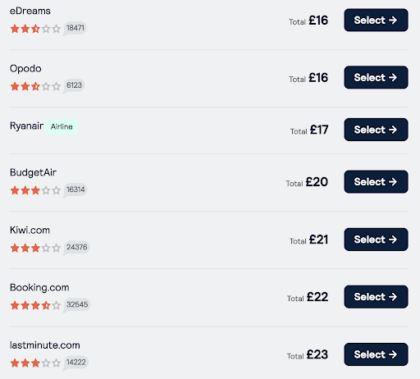

Research in October 2022 by Deloitte highlighted that 39% of individuals preferred to use an OTA to book their holiday over other methods such as booking flights and accommodation separately or using a high street travel agency. We then also have travel aggregator sites like Trivago and Skyscanner. These aggregate the best deals found directly with the supplier as well as the prices found on OTAs. These might be large OTAs like Booking.com and Expedia, in addition to smaller, less well-known OTAs.

Take a look at this example of a recent search for a flight to Dublin made on Skyscanner:

Why do OTAs and aggregators pose an SEO challenge?

Many OTA and aggregator sites are hugely authoritative and will dominate the SERPs for high volume, short-tail travel queries. For example, Booking.com and Tripadvisor have Domain Ratings of 93 and 92 respectively in Ahrefs.

If you search for anything related to accommodation or travel, you’ll most likely see several OTA or aggregator sites like these on page one and probably in the top three.

Couple that with the fact that the brand-recognition of sites like Skyscanner or Booking.com which means they’re often automatically the first port of call for users looking to book travel, and it’s easy to see why travel SEO can prove so difficult.

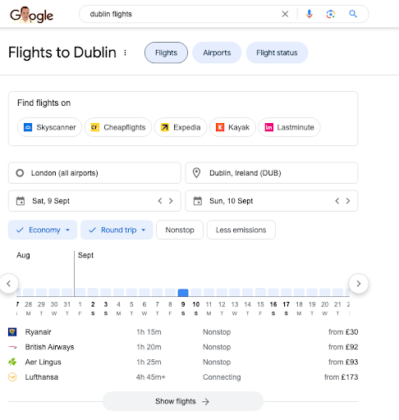

Google also poses a challenge to travel SEO

In addition to powerful OTA and aggregator sites, you’ll often find yourself up against Google itself, too.

When searching for flights, Google’s Flights integration uses data directly from airlines to populate its informative flights block. This appears right at the top of the SERP, meaning less real estate for natural listings below:

Ranking in the hotel pack

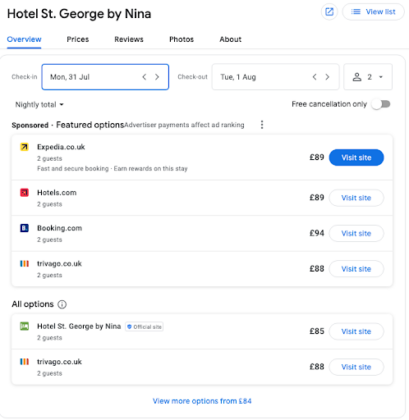

Similarly, searching for hotels returns the hotel pack at the top of the SERP.

This SERP feature looks similar to a local results page, but unlike a regular local map pack, clicking a link doesn’t take you directly to the hotel’s Google Business Profile, but to a Google Hotels price comparison engine. Within this, sponsored listings from OTAs receive the most prominent positions with free booking links appearing below:

Google has provided some documentation as to how it ranks hotels, but the key points are:

- Results are ranked by relevance. Like general organic rankings, a large number of factors are taken into consideration to determine which is the most relevant result.

- Three factors outlined by Google are location, price and user ratings/reviews.

- Results may be personalised based on previous searches or bookings.

- Any ads will be marked with ‘Ad’ or ‘Sponsored’.

Similar to local-focused Google Business Profile optimisation, hotels should focus on generating as many positive user reviews as possible.

Structured data = rich SERP listings

To appear in either the hotel or flights pack, using schema markup is essential.

The Flight and Hotel schema markup types should be fully populated if possible, because Google will then use this information to populate rich results on SERPs.

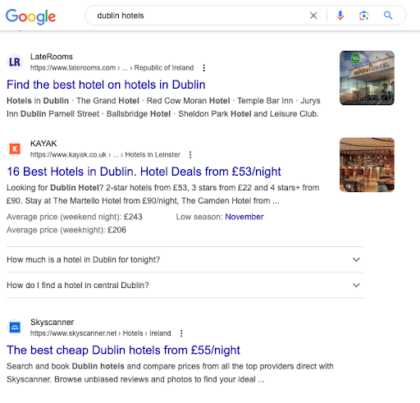

With competition on the SERP being so fierce, using structured data can also help those who are lucky enough to rank to stand out. Look at Kayak’s example on the ‘dublin hotels’ SERP:

This Kayak URL is using five schema types:

- BreadcrumbList

- ViewAction

- ItemList

- Hotel

- FAQPage

All of these allow Kayak to have such a rich result – displaying FAQs, average prices and even a clickable link to the cheapest month to stay in Dublin. The basic stuff is done well too – the meta description gets straight to the point with how much different price point hotels will cost.

In comparison, LateRoom, who is ranking above, is only using BreadCrumbList markup and has no meta description applied. In this case, despite ranking one position above, it’s likely that Kayak is managing to get more clicks than LateRooms thanks to the very rich result that should attract a higher CTR.

How else can travel companies compete in organic search?

Although it dates back to 2016, Google’s definition of four “micro-moments” that define the key opportunities for travel businesses to be discovered in search still remains valid in 2024:

- Dreaming moments

- Planning moments

- Booking moments

- Experiencing moments

At each of these moments, you need to have an SEO strategy that will ensure you have content in place to meet the specific needs of your customer at that stage.

This includes the start of the process when a customer is seeking inspiration and ideas, through to the actual planning of the trip, making the booking, and then finally doing more research once the trip is underway.

Search behaviour will lead them to start the general research process, and the corresponding SEO strategy is to generate rich content that provides inspiration whilst answering questions users may have.

Dreaming stage

Your site needs to be found at this early dreaming phase in order to move onto the next critical stages. At this stage, a long tail SEO strategy can be highly effective, targeting queries at this top end of the funnel. Some example queries that fit these ‘dreaming moments’ could be things like:

- Where is hot in October

- Cheapest time to stay in Dublin

- Best beaches in Greece

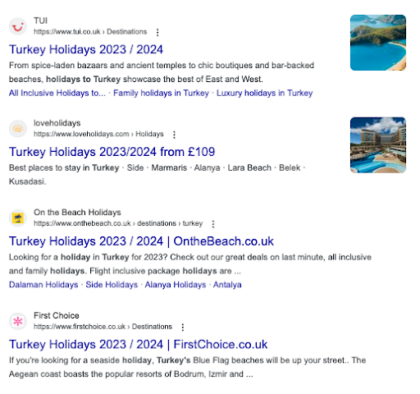

TUI’s /discover subfolder has done a great job of targeting terms at this stage, with articles such as ‘where is hot in…’ recreated for each month, along with ‘best time to visit…’ for most of their destinations. Articles like this are contributing to an estimated 80.4k sessions to the /discover section alone in the UK:

Planning stage

‘Planning moments’ happen once a destination has been chosen at this stage, users will be looking into things like prices, reviews, availability and things to do.

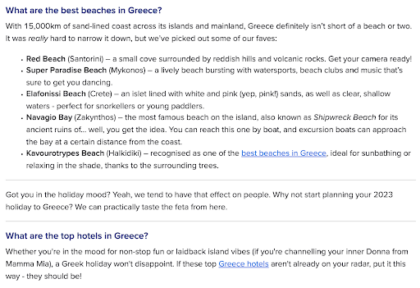

Similarly, On the Beach’s /destinations/ pages (such as https://www.onthebeach.co.uk/destinations/greece) work really well as SEO hub pages, ranking in the top three for terms like ‘tenerife holidays’ (60,500 searches per month) and ‘greece holidays’ (40,500 searches per month).

These pages answer questions like where the best beaches and hotels are and display things like average temperatures per month and Trustpilot reviews.

Things to do and travel advice are within separate tabs on the same URL, meaning the user can access this content if needed, but the main page has links to recommended hotels and prices to make booking as easy as possible rather than being faced with a big wall of content.

Searches at this planning stage will be things like ‘things to do in…’ and ‘hotels in…’. With these types of searches remaining incredibly competitive, we’d recommend honing in on your niche and targeting a more specific search.

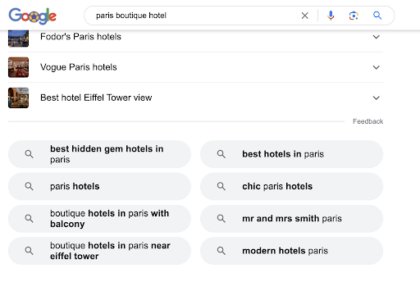

For example, if we were trying to rank for the query ‘paris boutique hotel’, we’d recommend carrying out some keyword research to identify some more refined terms you’d have a better chance of ranking for.

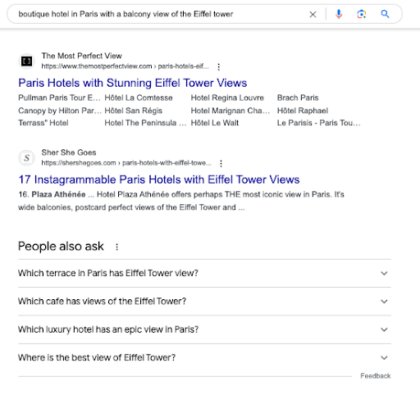

Carrying out some quick keyword research, in this case using Google’s suggested searches, highlights ‘boutique hotels in paris with balcony’ and ‘boutique hotels in paris near eiffel tower’ as potential target terms:

We could take that a step further and aim to target something like ‘boutique hotel in Paris with a balcony view of the Eiffel tower.’ The SERP is still competitive, but definitely less so than that original search. Plus, it’ll also offer more questions to answer that people are searching for as well as further content ideas to enrich the user’s travel planning experience.

We could take that a step further and aim to target something like ‘boutique hotel in Paris with a balcony view of the Eiffel tower.’ The SERP is still competitive, but definitely less so than that original search. Plus, it’ll also offer more questions to answer that people are searching for as well as further content ideas to enrich the user’s travel planning experience.

Particularly for smaller scale sites, targeting much more detailed, lower volume but highly relevant queries will give you a good chance of flying under the radar of the large OTAs and ranking in the SERPs.

What else do you offer that may be easier to rank for?

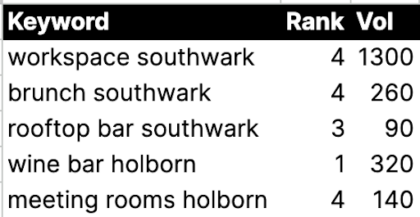

Looking to target queries at this planning stage, hotels should aim to get good organic visibility for their wider service offering.

For example, The Hoxton hotel has several locations across London, and is ranking well for terms related to its bars, restaurants and workspace areas:

Especially in more competitive cities, consider other services your hotel offers that might be easier to rank for than accommodation.

Users might be looking for things to do in the area and haven’t yet booked accommodation, so it’s a good opportunity to get in front of these prospective customers. Even if it doesn’t end up in a room booking, it’s traffic that might convert in another way, such as by visiting your bar or restaurant, contributing to building your brand awareness.

Booking and beyond

Part of the reason why OTAs and, increasingly, Google’s Explore section, are so popular is that they deliver exceptional UX when it comes to booking. With users still switching between mobile and desktop in order to make a booking, ensuring you deliver an exceptional mobile experience can remove users’ concerns around converting on mobile.

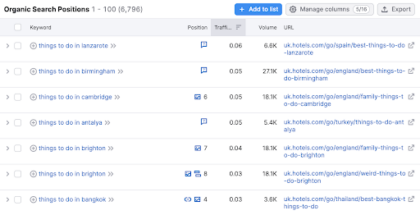

The ‘can’t wait to explore’ moments are when users are planning the things they’ll do whilst travelling. Providing useful information to travellers looking to plan activities is a great way to build organic visibility and brand awareness.

Online travel agent Hotels.com is ranking for nearly 7,000 keywords in the UK and driving 23,200 sessions a month to its /go/ sub-folder from queries containing ‘things to do’ alone!

Future trends in travel SEO

The main thing to keep an eye on is an increasing trend of more travel research and booking happening within Google’s interface, as opposed to on websites themselves.

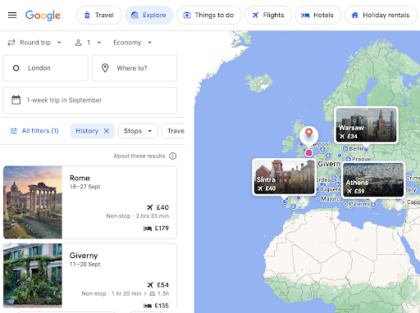

In April 2023, Google released some new features pertaining to how users browse travel-related content on Google.

Aiming to make it easier to browse hotels and book plane tickets, especially on mobile, these changes introduced swipeable image stories for hotels and a ‘price guarantee’ for flights, which will even refund users the difference if the price of a flight becomes lower than what Google guaranteed.

Additionally, Google has started displaying more prices of attractions and direct links to book.

Currently, within Google Travel’s Explore interface, it’s possible to select the month you want to travel, preferred duration, budget and even your interests, and Google will return some options for you.

Here’s some results for a prospective week long trip in September with a focus on history:

All of this helps keep users on Google whereas previously they may have been carrying out that research in the different travel planning moments elsewhere.

It will become increasingly important to ensure that you’re visible where users are carrying out their travel research. If that’s within Google then a focus on ensuring you meet Google’s relevance requirements and implementing accurate structured data will be more important than ever.

If you have any further questions, contact us or follow us on LinkedIn.